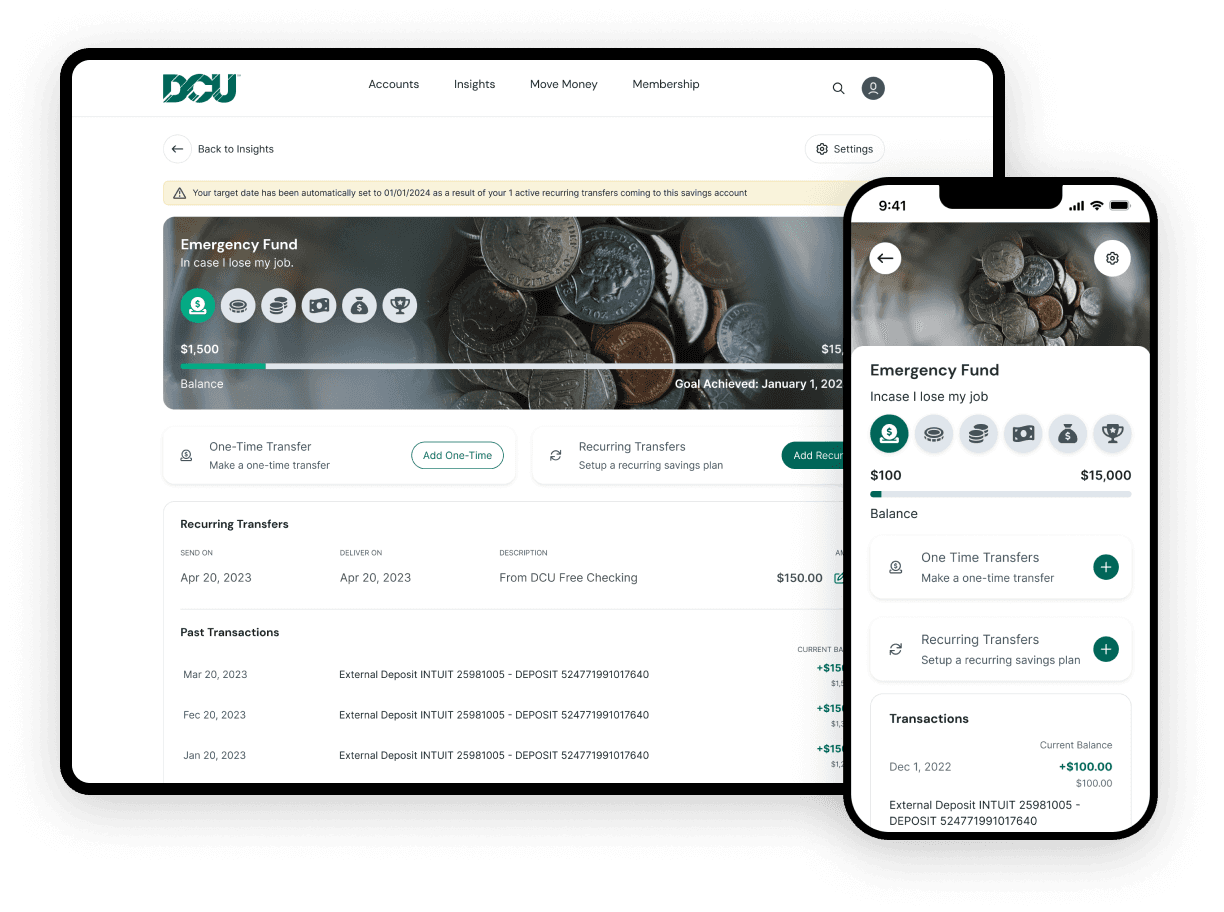

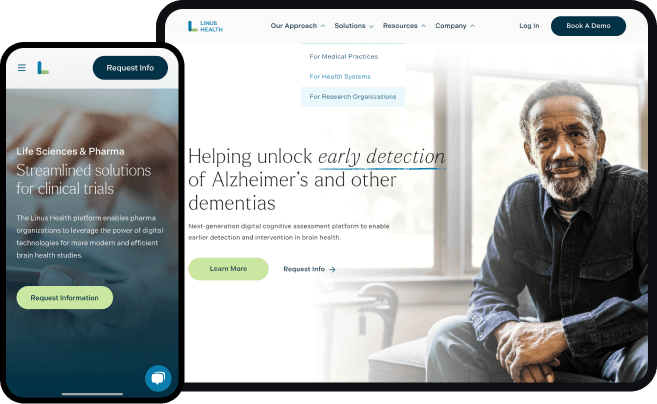

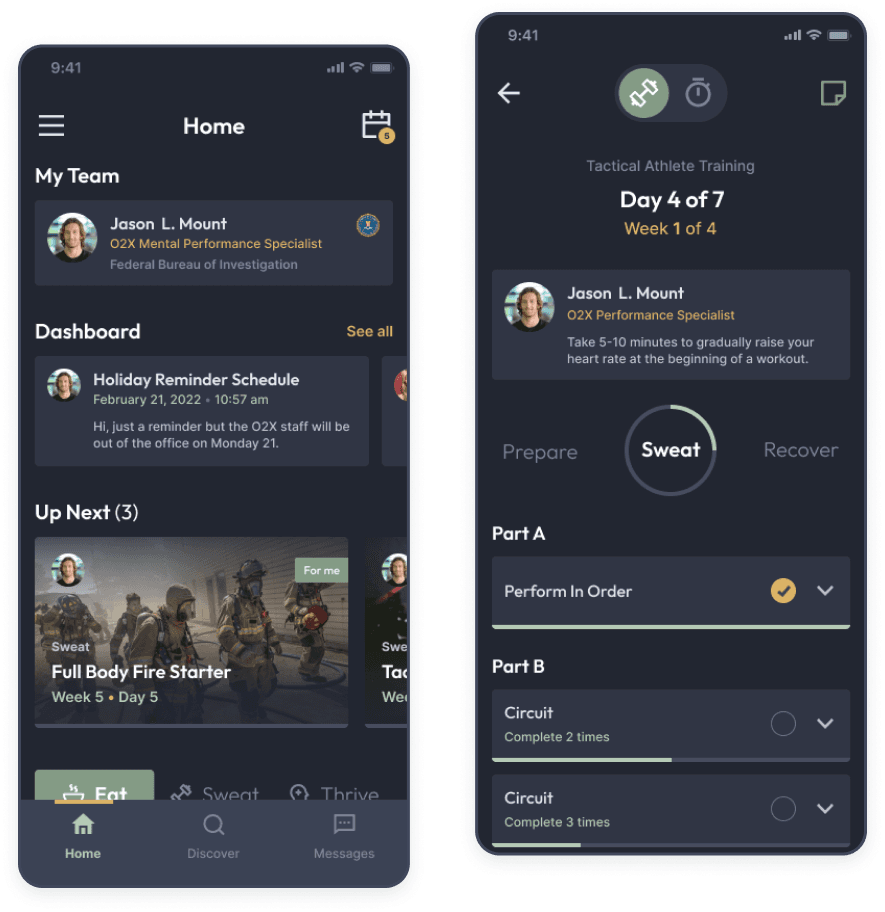

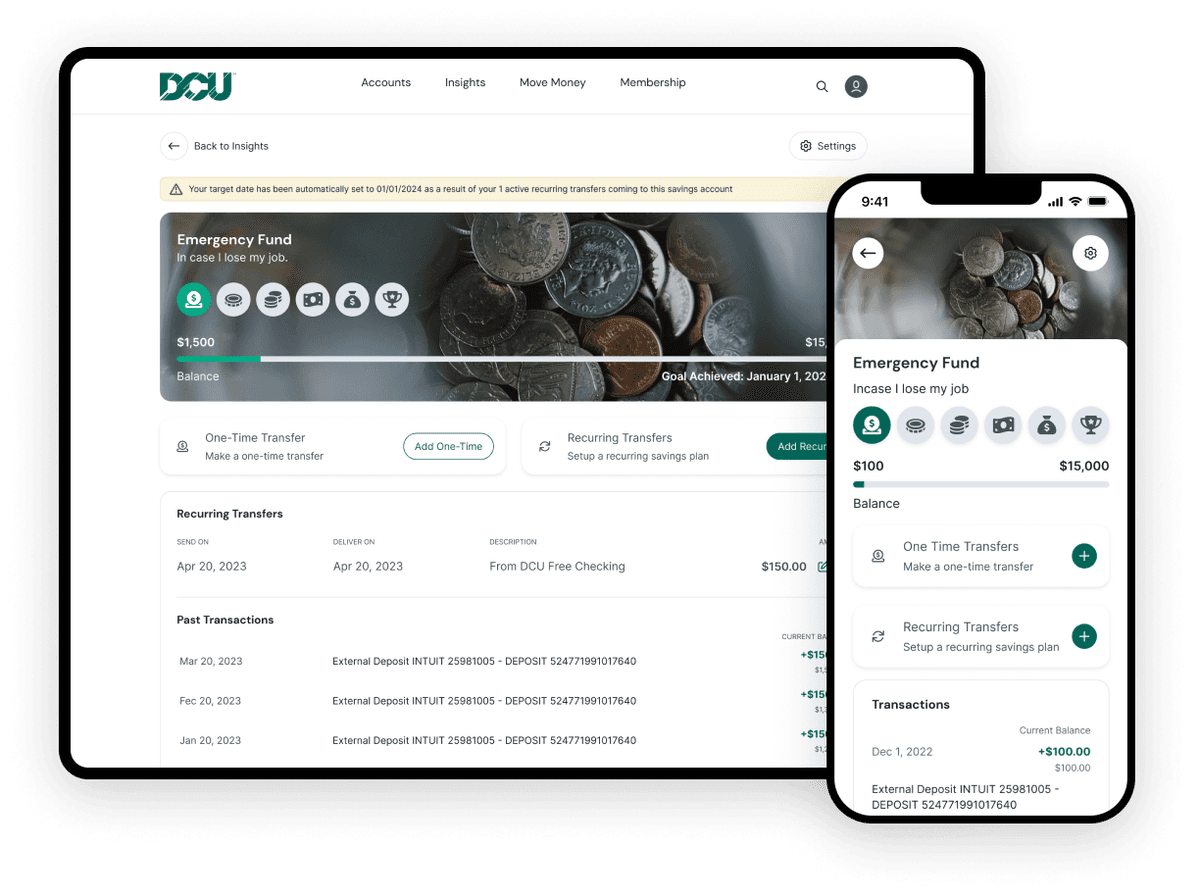

Elevating Digital Banking

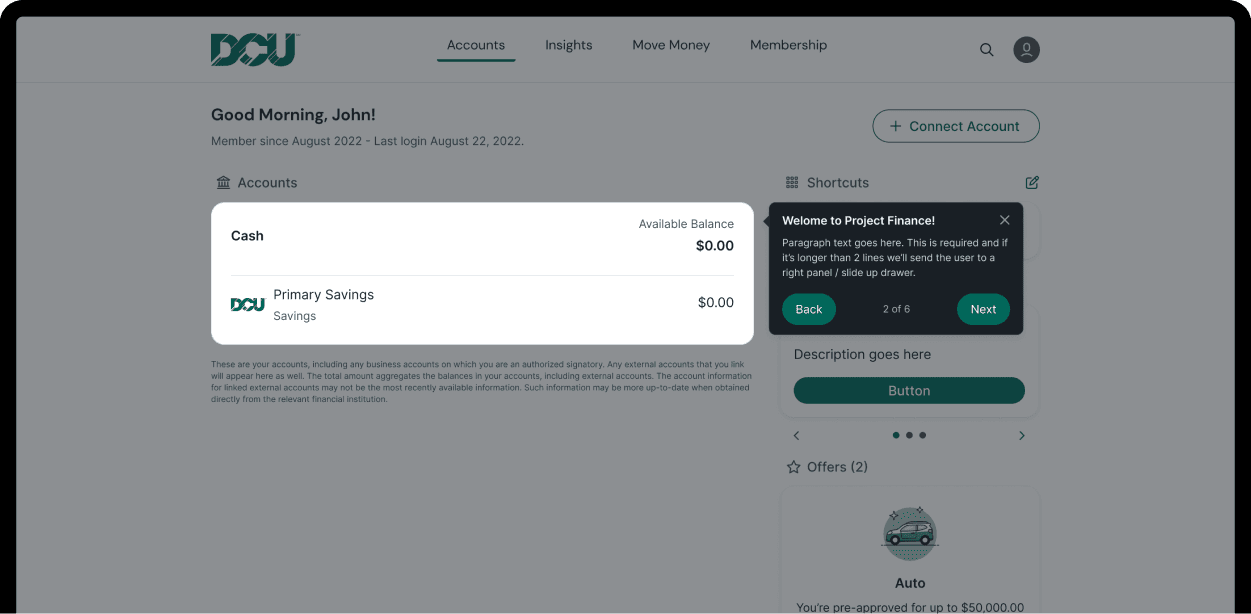

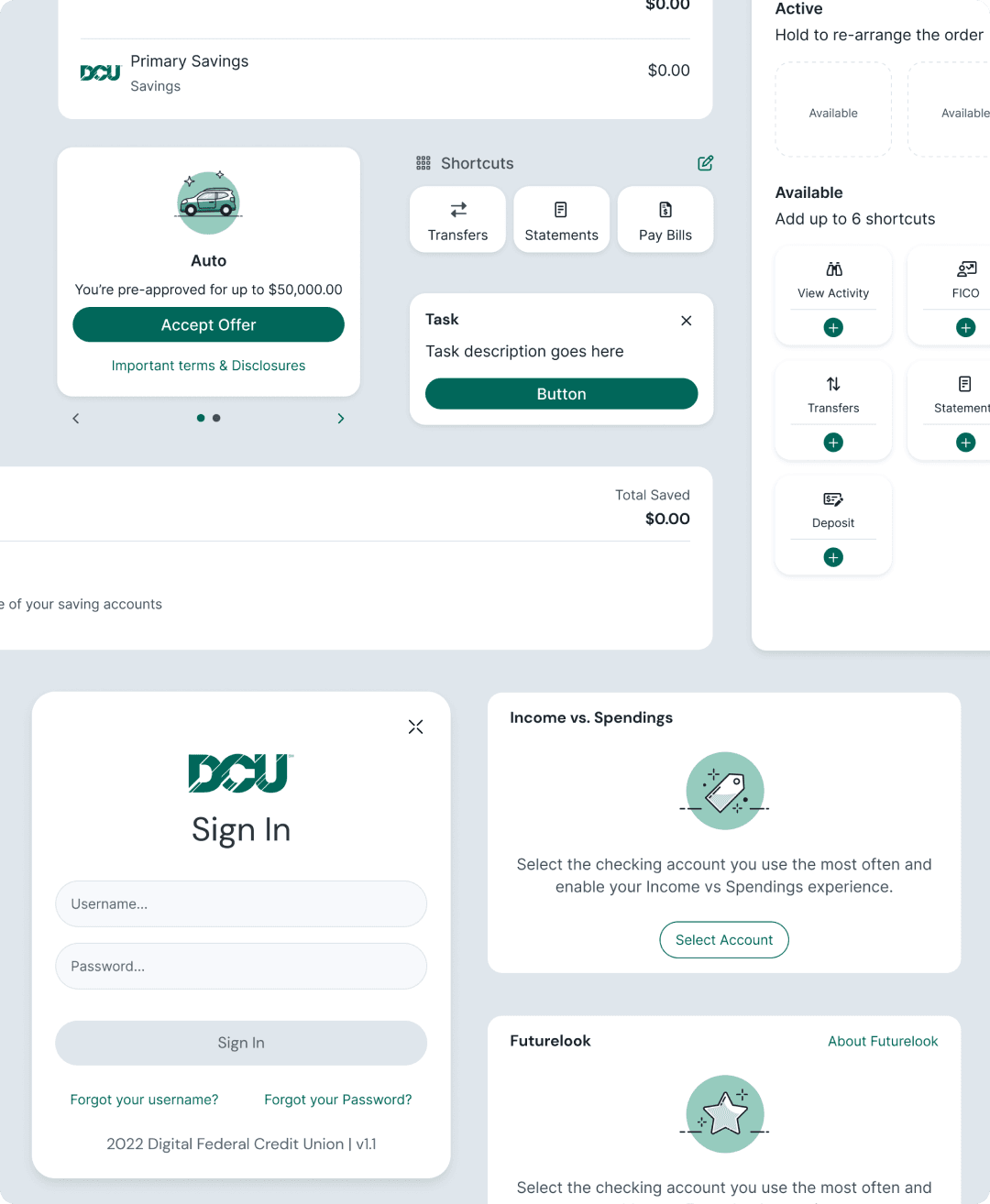

For over 4 years, we've led product design across DCU's web and mobile platforms, while also providing frontend engineering for their web application. We fundamentally reshaped their operating model, allowing them to scale digital banking experiences with confidence, speed, and data-backed decision making.

Problem

Before engaging VisualBoston, their design and development process was functional but fragmented, with slower throughput, limited confidence in design decisions, and inefficient iteration cycles.

Our Approach

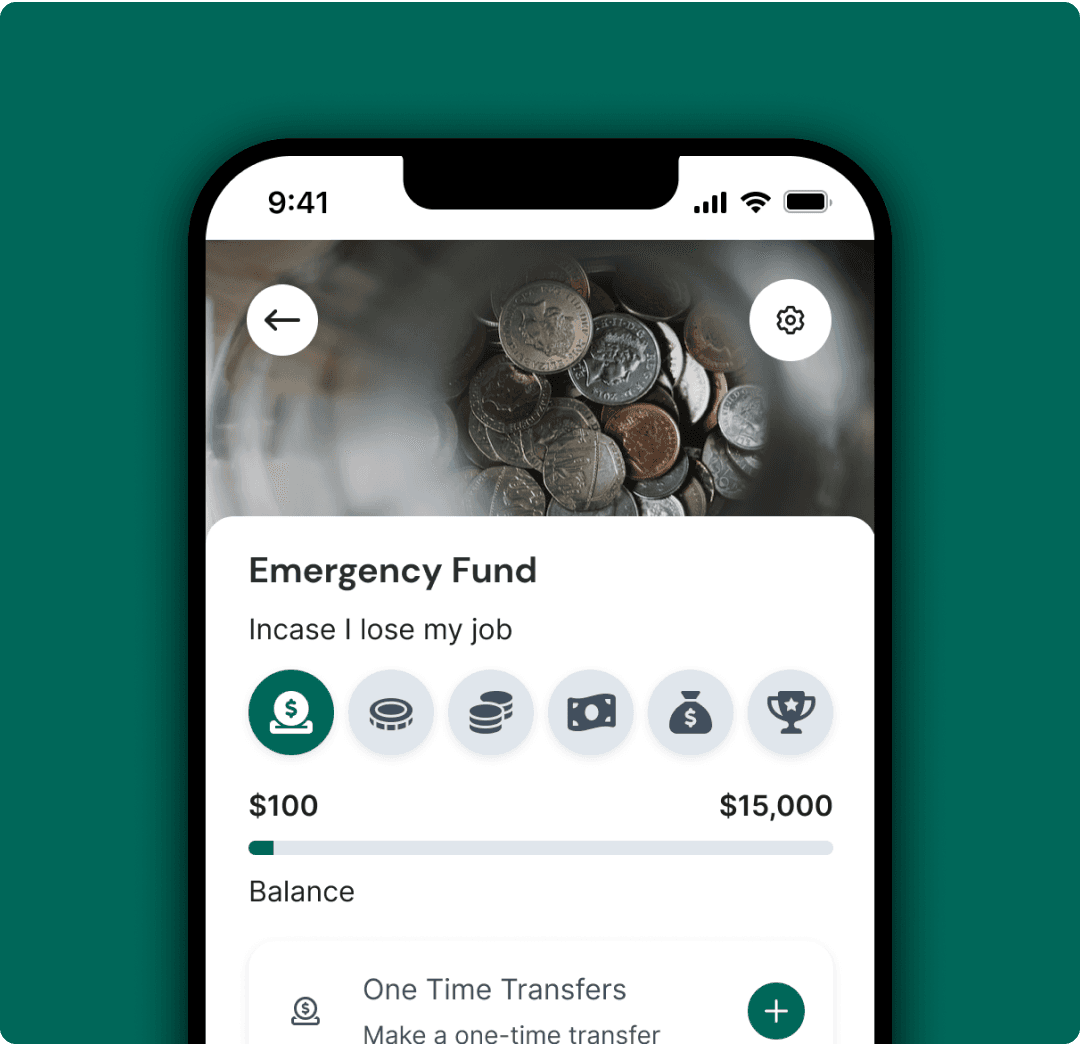

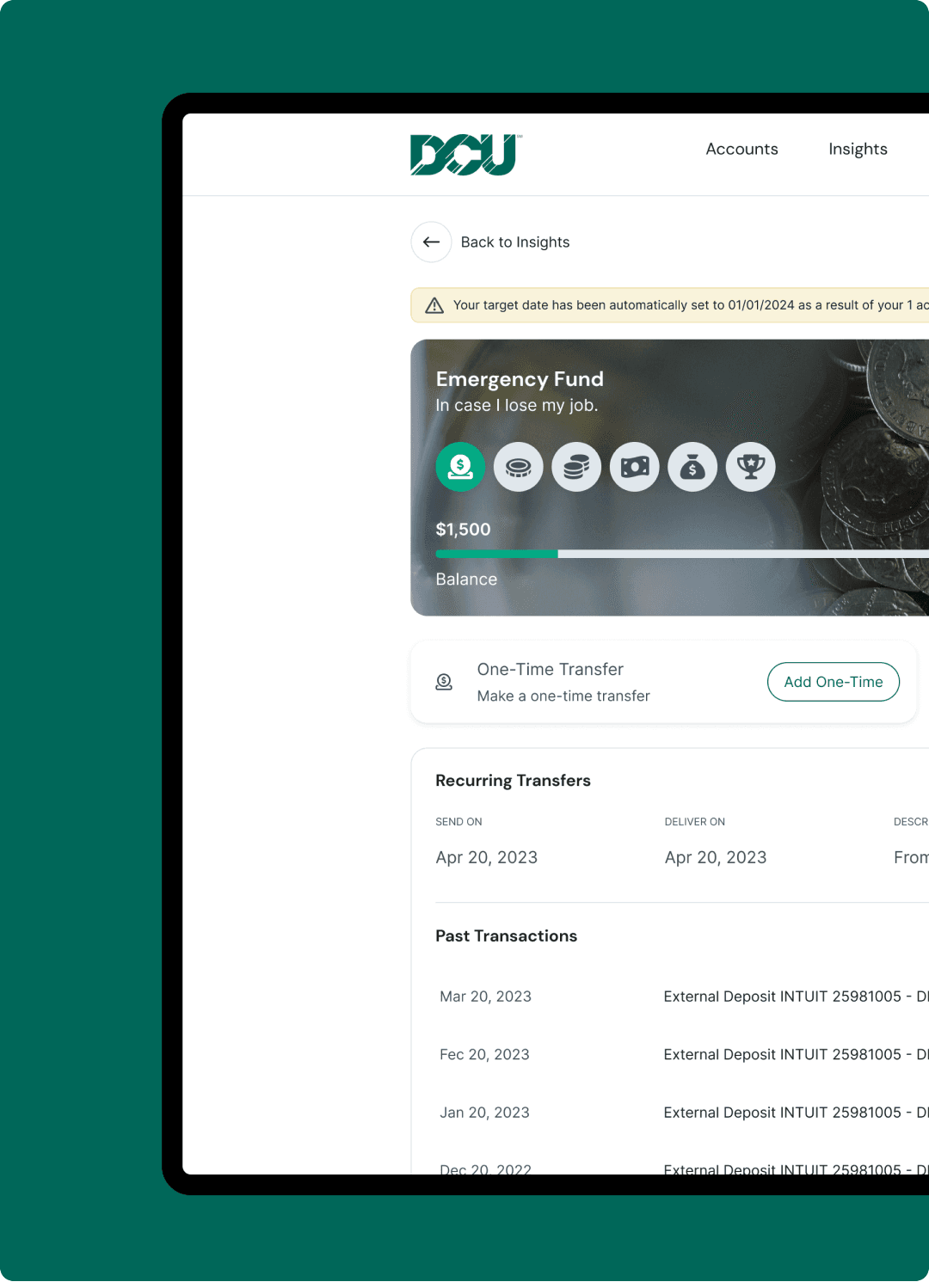

Through close collaboration with their team, we've built a process that has streamlined DCU's entire product design process and modernized their web and mobile applications.

About the Project

The Challenge

When we began working with Project Finance, their design and development process was functional but fragmented. They faced several key bottlenecks:

- Slower throughput from design-to-development handoff

- Limited confidence in design decisions due to insufficient data validation

- Inefficient iteration cycles that slowed product delivery

They could ship products, but not always with the speed or clarity needed for a competitive digital banking environment.

Our Approach

We partnered with Project Finance to re-engineer how their design and development teams collaborated. Our team implemented a new operating model that transformed their linear handoff process:

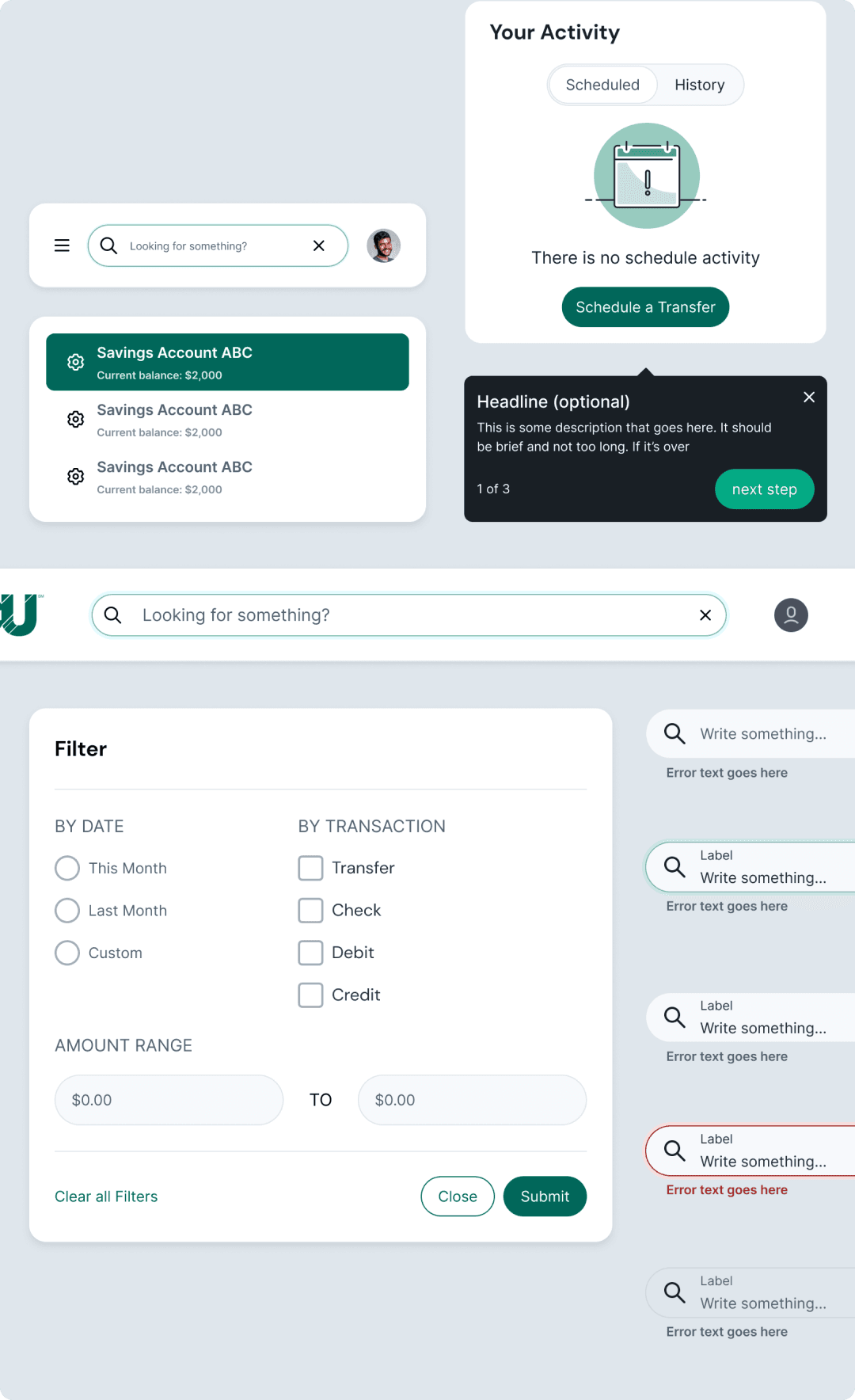

- Collaborative design system – We created unified design standards that aligned designers, developers, and product owners

- Data-driven validation – Our team embedded user testing and behavioral data into early design decisions, ensuring every interface was validated against real user needs

- Streamlined workflows – We established clear documentation standards, reusable component libraries, and tighter iteration loops between design and development

The Results

Our systematic approach delivered measurable improvements across their entire product development process:

- Faster throughput – Design-to-development cycles became 40% faster and significantly more predictable

- Confident decisions – Data-backed designs reduced costly rework by eliminating guesswork from the design process

- Team alignment – Product, design, and engineering teams now operate from unified standards, minimizing friction and miscommunication

Strategic Impact

Our work with Project Finance went beyond surface-level design improvements. We fundamentally transformed their operating model, enabling them to scale digital banking experiences with confidence, speed, and data-backed decision making.

This systematic approach has allowed their team to consistently deliver user-centered financial products that meet both customer needs and business objectives.

Achieve Similar Results for Your Business

See how strategic design thinking could transform your product. Let's explore what's possible for your unique challenges.